CMA History تاريخ شهادة زمالة جمعية المحاسبين الأداريين

ولذلك أنا هأحاول معاكم نستعرض تاريخ الشهادة وما هو أساسها وكيف نشأت ودة من خلال الموضوع دة والحقيقة نظرا لغزارة المعلومات في هذا الموضوع فأنا هأنشرة على حلقات ليستفيد الجميع كما أني فضلت أن يكون الموضوع بالإنجليزية لأننا محاسبين محترفين ولسبب آخر هو أنك إذا أردت العلم فخذة كما هو ومن مصدرة وبلغتة الأصلية لأنة أحيانا تغير الترجمة مضمون الكلام

نبدأ مع بعض

History of the CMA Examination

Although the intent of the program has not changed, the CMA examination itself has gone through a number of changes, including both the both format and the examination method.

The CMA exam was originally a five-part examination that included both free response (essays and problems) and objective (multiple choice) questions. In 1990 the examination changed to four-part format, include both free response and multiple choice questions, but exempted Certified Public Accountants (CPAs) from taking one of its parts (Part 2). In 1990 the exam made its most recent revision to an entirely computer-based examination method, using exclusively multiple choice questions and maintaining the CPA exemption for part 2.

In 1990 the CMA examination went on to adopt a non-disclosure policy. Although the examiners provide detailed content specification descriptions and provide significant information about the textbooks from which the exam content is taken, the specific questions asked by the examiners in the most recent exams are not published by the IMA or otherwise made available, except for a small number of sample questions.

Taking the exam without the benefit of a highly organized and focused review program is now more difficult than ever.

CMA is the acronym for Certified Management Accountant.

The CMA examination is developed and offered by the Institute of Certidied Management Accountants (ICMA) in approximately 200 locations in the U.S. and an additional 200 international locations.

The Institute of Management Accountants (IMA)

Conceived as an educational organization to develop the individual management accountant professionally and to provide business management with the most advanced techniques and procedures, the IMA was founded as the National Association of Cost Accountants in 1919 with 37 charter members. It grew rapidly, with 2,000 applications for membership in the first year, and today it is the largest management accounting association in the world, with approximately 75,000 members and more than 300 chapters in the U.S and abroad.

The IMA has made major contributions to business management through its continuing education program, with courses and seminars conducted in numerous locations across the country; its two magazines, Strategic Finance, which is a monthly publication, and Management Accounting Quarterly, which is an online journal; other literature, including research reports, monographs, and books; a technical inquiry service; a library; the annual international conference; frequent meetings at chapter levels; and communication through online member interest groups and email exchanges.

The Institute of Certified Management Accountants (ICMA)

The ICMA is located at the IMA headquarter in Montvale, New Jersey. The only function of the ICMA is to offer and administer the CMA designation. The staff consists of the managing director, the director of examinations, and support staff. The ICMA occupies about 2,000 square feet of office space in the IMA headquarters. This office is where new examination questions are prepared and where all records are kept.

ICMA Board of Regents Staff

The ICMA Board of Regents is special committee of the IMA established to direct the CMA program for management accountants through the ICMA. The Board of Regents consists of between 12 and 16 regents, one of whom is designated as chair by the president of the IMA. The regents are appointed by the president of the IMA to serve 3-year terms. Membership on the Board of Regents rotates, with one-third of the regents being appointed each year. The regents usually meet twice a year for 1 or 2 days.

The managing director of the ICMA, the director of examinations, and the ICMA staff are located at the ICMA office in Montvale, NJ. They undertake all of the day-to-day work with respect to the CMA program

The CMA certification program has four objectives:

-To establish management accounting as a recognized profession by identifying the role of the management accountant and financial manager, the underlying body of knowledge, and a course of study by which such knowledge is acquired;

-To encourage higher educational standards in the management accounting field;

-To establish an objective measure of an individual’s knowledge and competence in the field of management accounting; and

-To encourage continued professional development by management accountants.

The exam tests the candidates’ knowledge and ability with respect to the current state of the field of management accounting.

Overall CMA Examination Content

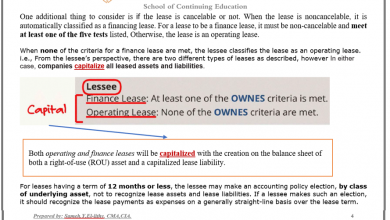

The ICMA has changed the CMA program from a four-part to a two-part exam. The new two-part exam is effective on May 1, 2010. After March 31, 2010, candidates will enter only into the new two-part program. The two parts of the CMA exam test proficiency in board subject areas that comprise the generally accepted knowledge base required of accountants serving industry. These parts include:

Part -1

Financial Planning, Performance and Control (Levels A, B and C)

(4 hours – 100 multiple-choice questions and two 30-minute essay questions)

A- Planning, Budgeting and Forecasting (30%) – LEVEL C

B- Performance Management (25%) – LEVEL C

C- Cost Management (25%) – LEVEL C

D- Internal Controls (15%) – LEVEL C

E- Professional Ethics (5%) – LEVEL C

Part – 2

Financial Decision Making (Levels A, B, and C)

(4 hours – 100 multiple-choice questions and two 30-minute essay questions)

A- Financial Statement Analysis (25%) – LEVEL C

B- Corporate Finance (25%) – LEVEL C

C- Decision Analysis and Risk Management (25%) – LEVEL C

D- Investment Decisions (20%) – LEVEL C

E- Professional Ethics (5%) – LEVEL C

Examination Methodology and Scoring

Each part of the examination is 4 hours long and is comprised of 100 multiple choice questions.

There is not penalty for incorrect answers. Exam candidates should guess if unsure and answer all questions.

Examinations are taken on computer at various testing centers. Pass/fail results are available after completion of the exam after 8 weeks.

The scores given on the exam are “Scaled” and range from 200 to 500 with the passing score equal to 360

Pass/fail status on the exam is based on standards established by the examiners. The results are not curved in any traditional sense. The examiners anticipate a level of knowledge and the achievement of a particular score for passing.

Examiners use a process known as “equating” to ensure that all examinations are of equivalent coverage and evaluated at equivalent levels of difficulty. The examiners are aware that exams will vary in difficulty to some degree, and they recognize this variability in the manner in which the correct answers are converted into scaled results. More difficult exams require less correct answers than less difficult exams to achieve the passing score of 360.

Content Specification Outlines

The Institute of Management Accountants (IMA) has published a Content Specification Outline (CSO) for all 2 parts of the CMA examination. The CSO is essentially a guide to the subject matter the IMA has determined that a candidate should have developed a thorough understanding of before sitting for the CMA exam.

Candidates for the CMA designation are expected to have a minimum level of business knowledge that transcends both examination parts. This minimum level includes knowledge of basic financial statements, time value of money concepts, and elementary statistics.

Learning Outcome Statements

The IMA has published a series of learning outcome statements (LOSs) that provides the candidate with the information the IMA expects the candidate to possess for successful completion of the CMA examination.

Types of Exam Questions

Materials published by the IMA define four different types of exam questions which, of course, may be tested at the different levels of coverage described above. Exam questions are defined as follows:

– Closed stem items. A complete question is posed, and the candidate must select the answer from four selections.

– Sentence completion items. An incomplete sentence is presented, and the candidate must select the most appropriate sentence completion from four selections.

– Except format items. An assertion is made, and all the four selections provided in the answer are either true or false, except for one response. The candidate must identify and select the exception.

– Most/least/best format items. One of the four selections provided either most, least, or best meets the criteria described in the question.

How to prepare yourself for the examination

The Institute of Management Accountants allows candidates to take the CMA examination in stages. Candidates can take all two parts of the exam, or even one part of the exam at any one sitting.

The CMA exam’s flexibility allows you to determine your examination strategy, based on both your knowledge and the time commitment you are able to make towards preparation.

First, map out a schedule that will allow you to review the textbook for basic familiarity. Second, listen to the lecture in detail. Third, do the homework problems to reinforce what you have learned. Finally, take time to do additional study of the text material. With a non-disclosed exam, additional study of the text is an extremely important step. Of course, be sure to set aside adequate time for a final review at least a week before sitting for your exam. Prepare flashcards as you review your lecture notes before working the multiple-choice questions (you can identify those flashcards you would like by making a mark for a flashcard, such as “FC”, in the margin of your outline during class). It will benefit you when you prepare personal flashcards because repetition is a very effective learning tool. The secret to memorization is “repetition”. Select major concepts from your class materials (outlines). Do not prepare flashcards for everything in the outlines (the outlines are already in a summarized format). Only make a flashcard for the major concepts, general rules and exceptions, mnemonics, formulas, and important lists. Items to consider:

1- Mnemonics and formulas

2- “Heavy on exam” notations

3- “Memorize” notations

4- Other major concepts you note while reading the explanations to the multiple-choice questions

5- General rules and exceptions

Keep your flashcards as simple as possible, but do not sacrifice correctness for brevity. Use whichever size is easiest for you to carry around. Write the question, the general rule, or the title of the list you are trying to memorize on the front, and write the answer, the exceptions, or the list, as applicable, on the back.